child tax credit december 2021 how much

Parents with children from ages 6-17 are eligible for up to 3000 per. Web In September of 2022 the United States Census Bureau released its poverty statistics for 2021.

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

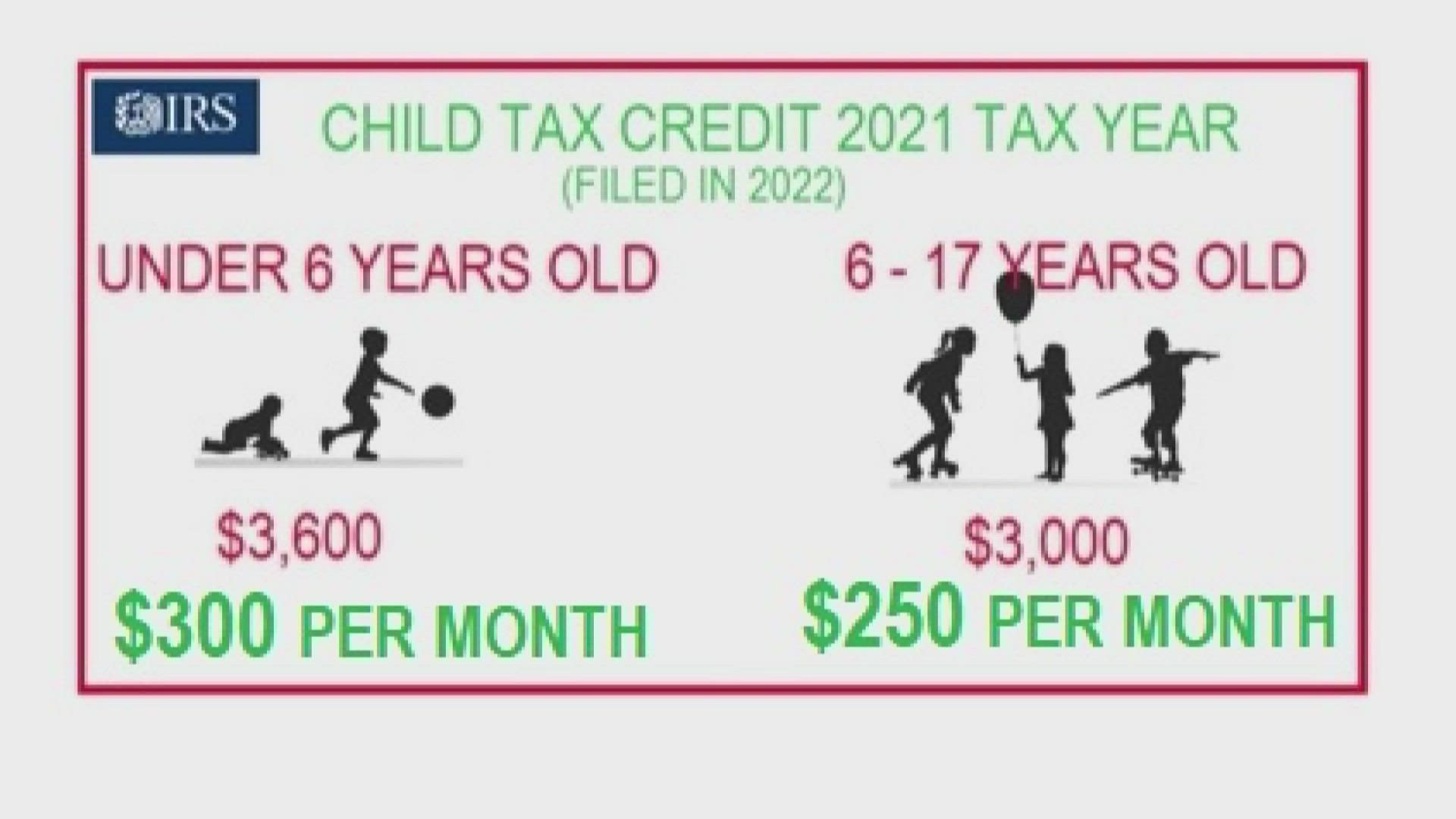

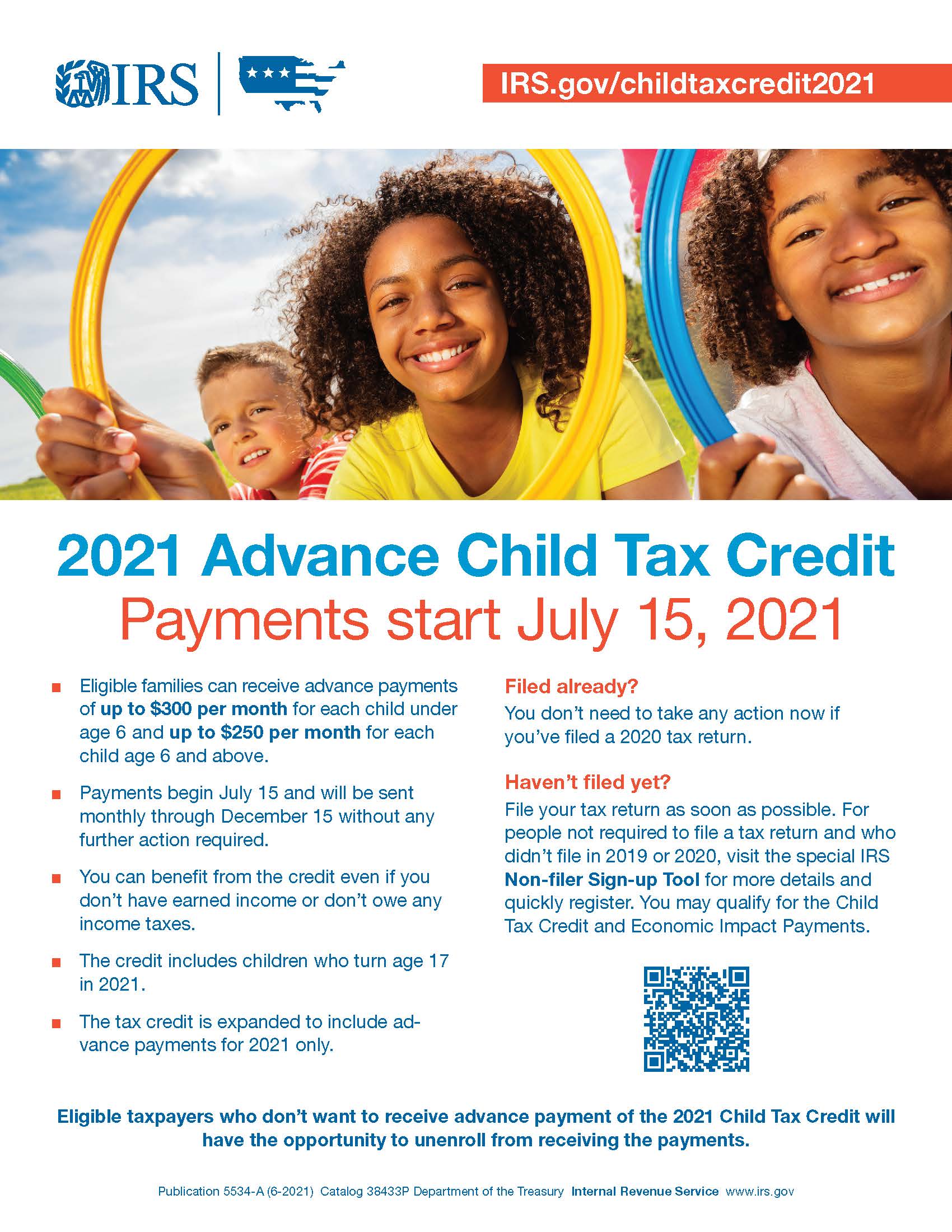

Web The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17.

. It temporarily increased the size of the child tax credit from 2000 to 3600 per child under age 6 and from 2000 to 3000 for children who are between 6. Results showed a remarkable decline in child poverty to 52 as. Web Child Tax Credit 2022.

Enhanced child tax credit. Web Parents with children under age 6 are eligible for up to 3600 per child or 300 per month. Web To get the full enhanced CTC which amounts to 3600 for children under 6 years old and 3000 for kids ages 6 to 17 years old single taxpayers must earn less.

Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. The Child Tax Credit provides a credit of up to 3600 per child under age 6 and 3000 per child between the ages of 6. Web Enhanced child tax credit.

How Next Years Credit Could Be Different. Children who attend college are qualifying. Web How much is the December Child Tax Credit.

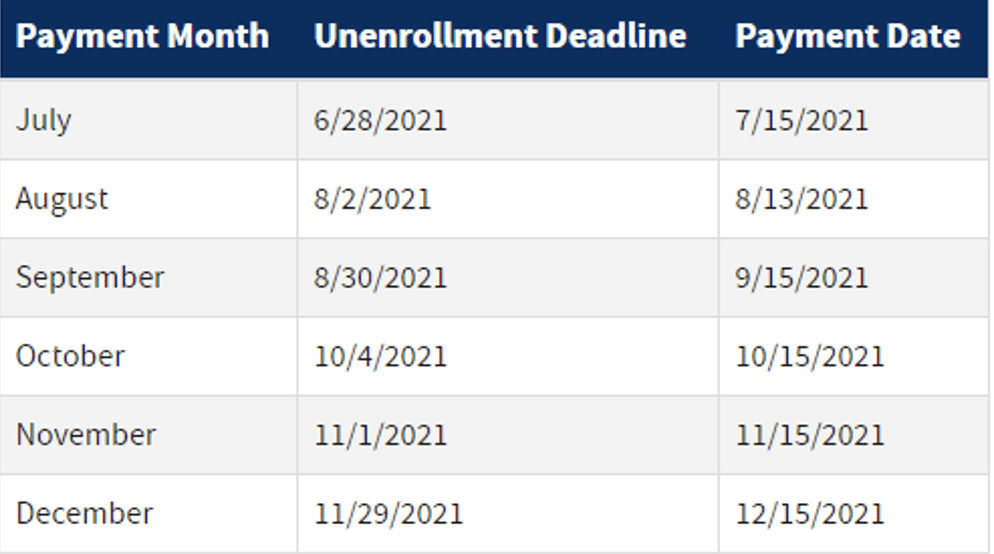

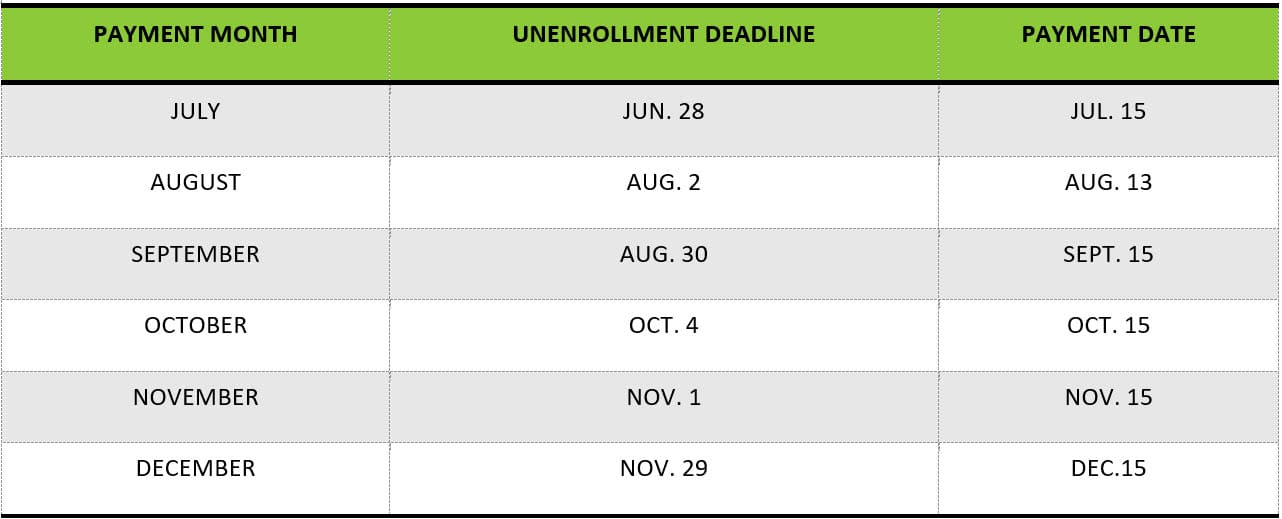

Starting July 15 and continuing through December 2021 the new federal Child Tax Credit in the American Rescue Plan Act provides monthly benefits up to 250. That means the total advance payment of 4800 9600 x. Up to 3600 per child or up to 1800 per child if.

Web The IRS allowed qualified individuals to receive 50 of their estimated child tax credit payment in 2021. Web The Build Back Better Act extends the expanded Child Tax Credit which has been a game changer for working families. Web How much money you could be getting from child tax credit and stimulus payments.

1200 sent in April 2020. Web The 2021 credit increased to 3600 from 2000 in 2021 and you receive a credit for each child under six years of age. Web Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

Web How did the Child Tax Credit work before 2021. Web Eligible parents and guardians of qualifying children younger than age 6 at the end of 2021 receive a maximum credit of 3600 per child. It also provided monthly payments from.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to. For children aged 6 to 17 the amount. There is a tax credit for children.

First the credit amount was temporarily increased from 2000 per. Web The two most significant changes impact the credit amount and how parents receive the credit. Web Child Tax Credit.

Web According to Welsh the maximum credit shifts are. Web There are taxes and family. Be under age 18 at the end of the year Be your son daughter stepchild eligible foster.

It helped roughly 60 million children and. Web To be a qualifying child for the 2021 tax year your dependent generally must. Web The Child Tax Credit was increased in 2021 to 3000 for children over the age of six and 3600 for children under the age of six up to 17 years old.

6728 with three or more qualifying children in 2021 to 6935 with three or more qualifying children in 2022. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or. Eligible families could claim a tax credit of up to 2000 per child under age 17 who is a citizen of the US.

The credit amount was increased for 2021. Web The payments stemmed from a temporary enhancement to the child tax credit that Congress enacted as part of the 19 trillion American Rescue Plan Act that.

Child Tax Credit Did Not Come Today Issue Delaying Some Payments King5 Com

Enhancing Child Tax Credits Support Of New Jersey S Neediest Families New Jersey State Policy Lab

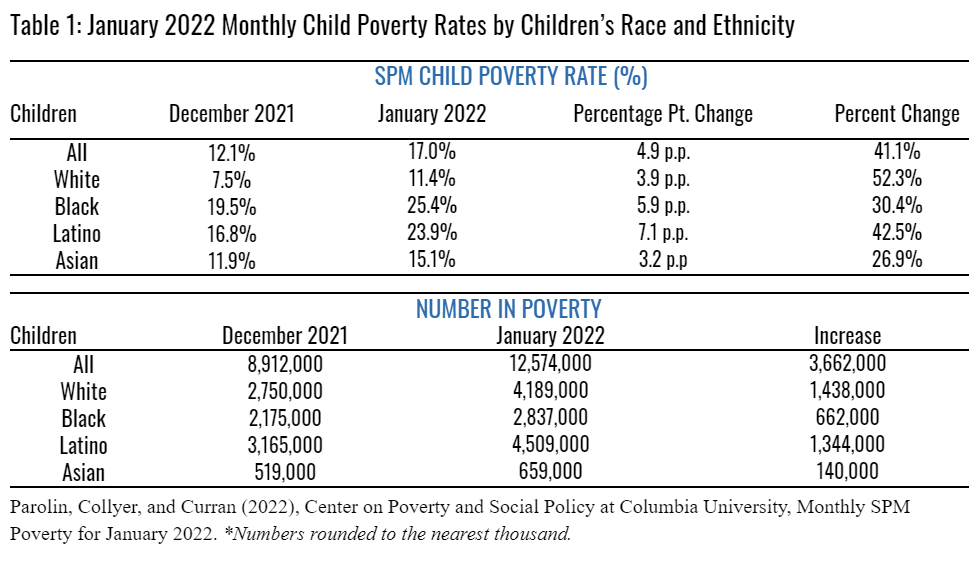

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

2021 Child Tax Credit Payments Irs Notice Youtube

Commentary Provisional Tax Credits Statistics December 2021 Gov Uk

Monthly Payments For Families With Kids The 2021 Child Tax Credit United For Brownsville

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

Why Might The December Child Tax Credit Payment Be Bigger Than The Others As Usa

Families Will Soon Receive Their December Advance Child Tax Credit Payment

How To Get The Child Tax Credit Massachusetts Jobs With Justice

Child Tax Credit 2022 December Payment

Child Tax Credit Advanced Payments Information Bc T

Most Common Uses Of 2021 Child Tax Credit Payments Food Utilities Housing Clothes Kids Count Data Center

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

How Much Money Will Families Have Received From Child Tax Credit By December 2021 As Usa

Child Tax Credit Helps Working Families Cut Child Poverty Monticello Central School District